Learn how to use technical charts to understand market patterns and trends (2)

The figure below depicts meth on the bar chart, where you can see the price on the x-axis, while

Time is on the side

Japanese candlestick charts

The Japanese invented this type of drawing and used it to evaluate rice contracts. Japanese candlesticks are similar to painting The bar graph in a number of aspects, as it expresses the other: opening, rising, decreasing, and closing for a specific period of time. When compared, Japanese candlesticks are easier to read than bar charts. So there's a structure.

Wide between the opening prices and the null cancellation of a specific period of time, this blank can be colored to determine whether Price action is destined for the highest or the lowest without a period of time.

We express the height in two colors: green and white.

We express the decline in two colors: red and black.

In the example below, the structure is colored black, and the opening price is shown at the top of the structure, while the closing price is below.

This indicates a depreciation of the price free of that period of time. If the structure were white, it would mean that the cost of the closure outperformed the opening price, and therefore there was an increase in value.

You'll also hear the term "priming," which derives from the candle priming your light in the birthday cake. She points out that The priming to the amount of price movement is free for a period of time, but that period is not the opening or closing (which is what is expressed in it).

Structure:

It also refers to areas of fighting between sellers and buyers.

Below we illustrate an example of a graph of Japanese candlesticks. The white color here expresses the color green, and black. About the redheads.

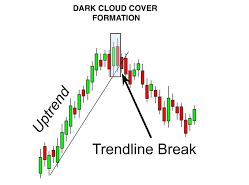

Japanese candlestick patterns

By comparing candlestick patterns with candlestick charts, we find that the models provide us with the possibility of predicting market changes, which helps In graph analysis. A whole school of thought is based on the moment and the use of those models.

About continuous models and market repercussions in specific assets. As we noted earlier, the shape of Japanese candlesticks is determined based on: opening, rising, falling, and closing at the origin Specifically without a specific period of time. You can witness the battle between buyers and sellers over a period of time, and infer On what may happen next.

Model of the swallow

This model shows the control of vendors (in black) in the time period shown on the left side.

Unable to move a huge move (the candle is small).

The refreshed candle (in white) The black candle with its entire structure. This is excellent evidence that the number of speculators is on the rise.

They control the market, and pressure on the top has become possible. The model also works in the opposite direction, where it is swallowed.

Black candle A small white candle.

Hammer or meteor

This model shows that buyers opened positions in that time frame close to the high candle, and for some reason, They lost a lot by dropping prices after staying for a while. And what interests him is that he and his uncle of the same time frame fought Bulls are bullish, and they manage to reach a higher price. This is a strong signal that the weight I've been using is exhausted.

Sellers and bulls remain in control of the market. This model also works in the opposite direction, The structure rises at the bottom (of the sellers), and the line above it (known as the wick).

Harami

Harami is similar to the model of belonging. The difference lies in: Clarifying the purchase of a winner in the battle between the sellers And buyers and the momentum is in favor of the winner. While Harami explains the loss of momentum, he will announce a winner among the sellers and buyers. When you see this pattern, there is a change in the direction of the price, or perhaps a strengthening occurs before a movement occurs.

Crucial. You have to be careful with this model.

hello, more information.

ReplyDeletevisit 1,3,4,5 & the new daily updates

Delete